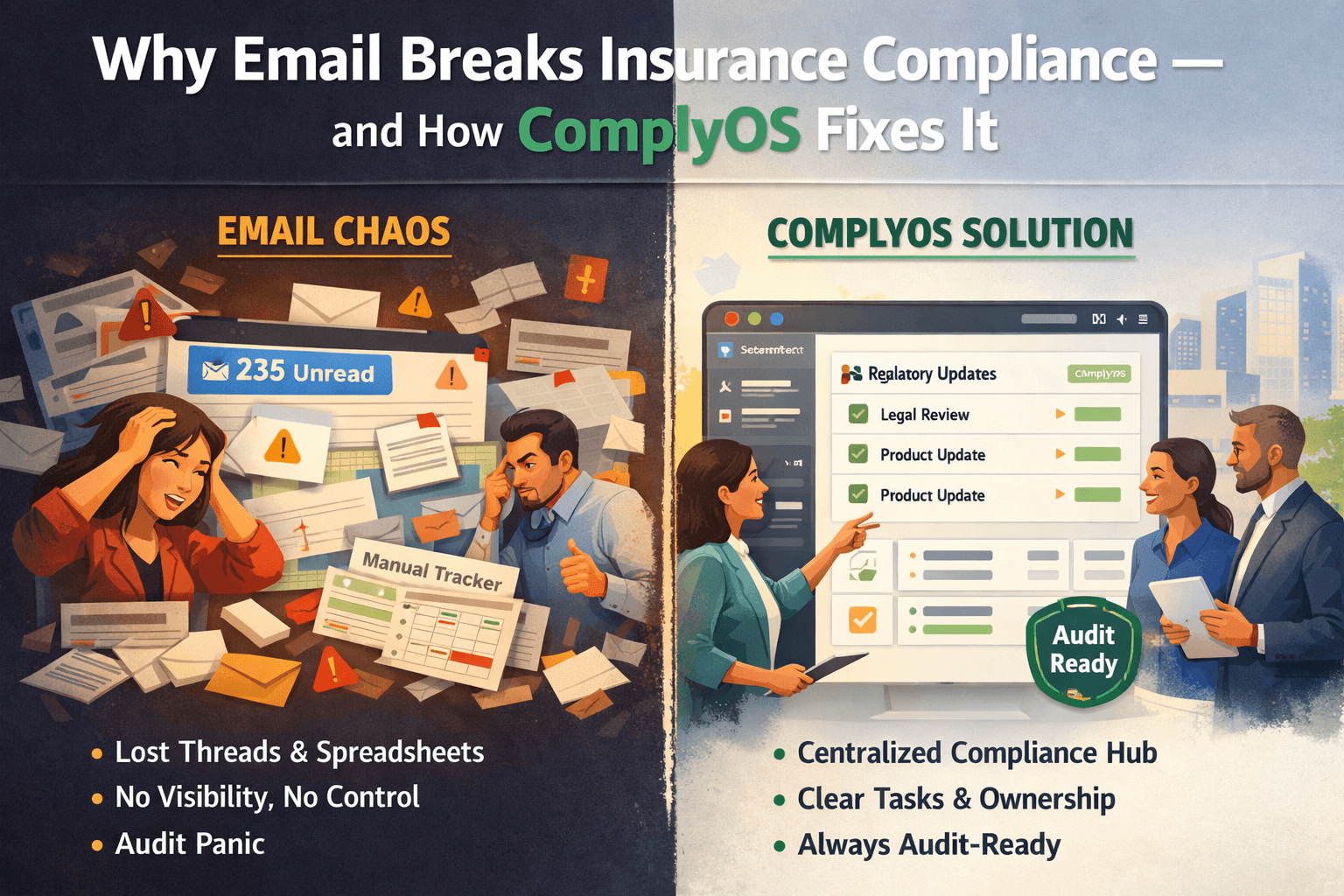

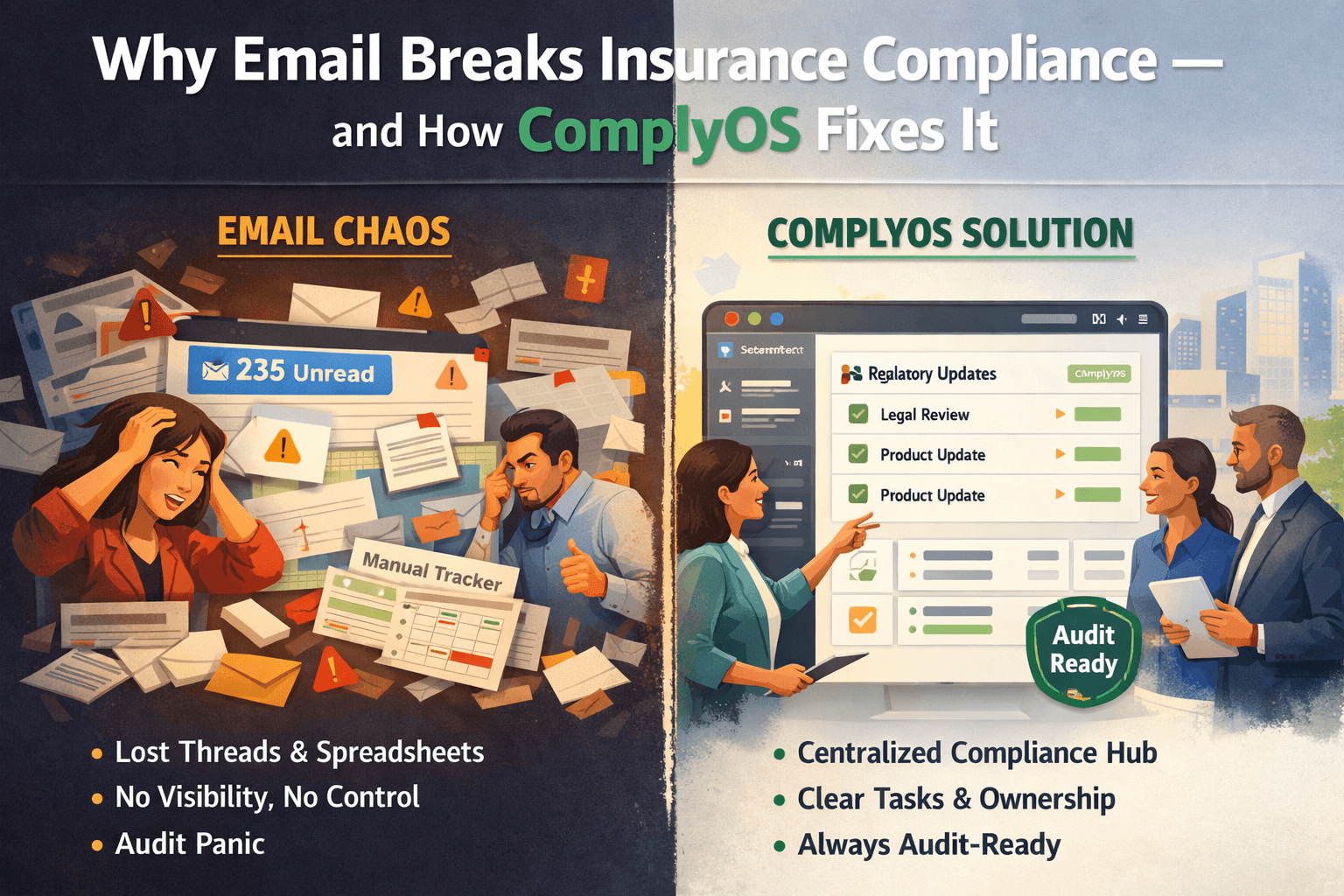

Why Email Breaks Insurance Compliance - and How ComplyOS Fixes It

Why Email Fails Insurance Compliance | ComplyOS for Regulatory Tracking

Email didn’t fail insurance compliance.

It was never meant to run it.

Yet most insurers still rely on inboxes to track regulations, coordinate teams, and prove compliance. The result? Slow execution, missed context, and growing regulatory risk.

This is exactly why ComplyOS exists.

The Real Problem: Compliance Is a System, Email Is Just a Message

Insurance compliance today is:

Continuous

Multi-state

Cross-functional

Audit-heavy

Email supports none of those requirements at scale.

Where Email Breaks Down (And ComplyOS Steps In)

1. Regulations Arrive - But Context Gets Lost

With Email

Bulletins forwarded without history

Interpretations buried in threads

Attachments become outdated instantly

With Comply

Every regulation enters a central intake

Original text, interpretations, and changes stay linked

One source of truth - always current

2. Compliance Is Cross-Team, Email Is Linear

Regulatory changes impact:

Legal

Product

Marketing

Underwriting

Operations

Email forces sequential follow-ups.

ComplyOS enables parallel execution.

What changes

Teams see only what impacts them

Tasks are assigned automatically

Deadlines are visible to everyone

3. No Visibility = No Control

With Email

Who reviewed it? Unknown

Who approved it? In another inbox

What’s pending? Spreadsheet guesswork

With ComplyOS

Real-time status by regulation

Clear ownership and accountability

Executive-ready compliance visibility

The Hidden Cost of Email-Driven Compliance

Operational Drag

Manual trackers

Endless follow-ups

Duplicate reviews

Regulatory Risk

Delayed implementation

Inconsistent interpretations

Weak audit trails

Human Burnout

Compliance becomes reactive

Teams firefight instead of govern

Comply: Built for How Insurance Actually Works

ComplyOS is not “email, but organized.”

It’s a Compliance Operating System.

What It Replaces

Inboxes

Shared drives

Static trackers

Memory-based compliance

What It Delivers

Central regulation tracking

Impact mapping across teams

Actionable workflows

Audit-ready documentation

Email Answers the Wrong Question

Email helps you ask:

“Did I send this?”

ComplyOS helps you answer:

“Are we compliant - right now?”

That difference matters to regulators.

It matters to executives.

It matters to your teams.

FAQs

Why is email bad for insurance compliance?

Email lacks structure, version control, and auditability - all critical for managing insurance regulations across teams and states.

Can compliance teams still start with email?

Yes, but email breaks quickly as regulatory volume and cross-team dependencies increase, creating operational and regulatory risk.

What makes ComplyOS different from email or trackers?

ComplyOS centralizes regulations, maps impact automatically, assigns ownership, and maintains a live audit trail - none of which email can do.

How does ComplyOS improve collaboration?

Each team sees only relevant regulatory impacts, works in parallel, and updates flow automatically across the organization.

Is ComplyOS built specifically for insurance?

Yes. ComplyOS is designed for U.S. insurance regulations, multi-state complexity, and insurer operating models by Comply.

Check our related articles

Deep Dive: Cross-Team Compliance Workflows

Final Takeaway

Email was built for conversations.

Insurance compliance is built on control, traceability, and speed.

ComplyOS doesn’t improve email.

It replaces the need for it.

Part 2 of this Article

Email didn’t fail insurance compliance.

It was never meant to run it.

Yet most insurers still rely on inboxes to track regulations, coordinate teams, and prove compliance. The result? Slow execution, missed context, and growing regulatory risk.

This is exactly why ComplyOS exists.

The Real Problem: Compliance Is a System, Email Is Just a Message

Insurance compliance today is:

Continuous

Multi-state

Cross-functional

Audit-heavy

Email supports none of those requirements at scale.

Where Email Breaks Down (And ComplyOS Steps In)

1. Regulations Arrive - But Context Gets Lost

With Email

Bulletins forwarded without history

Interpretations buried in threads

Attachments become outdated instantly

With Comply

Every regulation enters a central intake

Original text, interpretations, and changes stay linked

One source of truth - always current

2. Compliance Is Cross-Team, Email Is Linear

Regulatory changes impact:

Legal

Product

Marketing

Underwriting

Operations

Email forces sequential follow-ups.

ComplyOS enables parallel execution.

What changes

Teams see only what impacts them

Tasks are assigned automatically

Deadlines are visible to everyone

3. No Visibility = No Control

With Email

Who reviewed it? Unknown

Who approved it? In another inbox

What’s pending? Spreadsheet guesswork

With ComplyOS

Real-time status by regulation

Clear ownership and accountability

Executive-ready compliance visibility

The Hidden Cost of Email-Driven Compliance

Operational Drag

Manual trackers

Endless follow-ups

Duplicate reviews

Regulatory Risk

Delayed implementation

Inconsistent interpretations

Weak audit trails

Human Burnout

Compliance becomes reactive

Teams firefight instead of govern

Comply: Built for How Insurance Actually Works

ComplyOS is not “email, but organized.”

It’s a Compliance Operating System.

What It Replaces

Inboxes

Shared drives

Static trackers

Memory-based compliance

What It Delivers

Central regulation tracking

Impact mapping across teams

Actionable workflows

Audit-ready documentation

Email Answers the Wrong Question

Email helps you ask:

“Did I send this?”

ComplyOS helps you answer:

“Are we compliant - right now?”

That difference matters to regulators.

It matters to executives.

It matters to your teams.

FAQs

Why is email bad for insurance compliance?

Email lacks structure, version control, and auditability - all critical for managing insurance regulations across teams and states.

Can compliance teams still start with email?

Yes, but email breaks quickly as regulatory volume and cross-team dependencies increase, creating operational and regulatory risk.

What makes ComplyOS different from email or trackers?

ComplyOS centralizes regulations, maps impact automatically, assigns ownership, and maintains a live audit trail - none of which email can do.

How does ComplyOS improve collaboration?

Each team sees only relevant regulatory impacts, works in parallel, and updates flow automatically across the organization.

Is ComplyOS built specifically for insurance?

Yes. ComplyOS is designed for U.S. insurance regulations, multi-state complexity, and insurer operating models by Comply.

Check our related articles

Deep Dive: Cross-Team Compliance Workflows

Final Takeaway

Email was built for conversations.

Insurance compliance is built on control, traceability, and speed.

ComplyOS doesn’t improve email.

It replaces the need for it.

Part 2 of this Article

Email didn’t fail insurance compliance.

It was never meant to run it.

Yet most insurers still rely on inboxes to track regulations, coordinate teams, and prove compliance. The result? Slow execution, missed context, and growing regulatory risk.

This is exactly why ComplyOS exists.

The Real Problem: Compliance Is a System, Email Is Just a Message

Insurance compliance today is:

Continuous

Multi-state

Cross-functional

Audit-heavy

Email supports none of those requirements at scale.

Where Email Breaks Down (And ComplyOS Steps In)

1. Regulations Arrive - But Context Gets Lost

With Email

Bulletins forwarded without history

Interpretations buried in threads

Attachments become outdated instantly

With Comply

Every regulation enters a central intake

Original text, interpretations, and changes stay linked

One source of truth - always current

2. Compliance Is Cross-Team, Email Is Linear

Regulatory changes impact:

Legal

Product

Marketing

Underwriting

Operations

Email forces sequential follow-ups.

ComplyOS enables parallel execution.

What changes

Teams see only what impacts them

Tasks are assigned automatically

Deadlines are visible to everyone

3. No Visibility = No Control

With Email

Who reviewed it? Unknown

Who approved it? In another inbox

What’s pending? Spreadsheet guesswork

With ComplyOS

Real-time status by regulation

Clear ownership and accountability

Executive-ready compliance visibility

The Hidden Cost of Email-Driven Compliance

Operational Drag

Manual trackers

Endless follow-ups

Duplicate reviews

Regulatory Risk

Delayed implementation

Inconsistent interpretations

Weak audit trails

Human Burnout

Compliance becomes reactive

Teams firefight instead of govern

Comply: Built for How Insurance Actually Works

ComplyOS is not “email, but organized.”

It’s a Compliance Operating System.

What It Replaces

Inboxes

Shared drives

Static trackers

Memory-based compliance

What It Delivers

Central regulation tracking

Impact mapping across teams

Actionable workflows

Audit-ready documentation

Email Answers the Wrong Question

Email helps you ask:

“Did I send this?”

ComplyOS helps you answer:

“Are we compliant - right now?”

That difference matters to regulators.

It matters to executives.

It matters to your teams.

FAQs

Why is email bad for insurance compliance?

Email lacks structure, version control, and auditability - all critical for managing insurance regulations across teams and states.

Can compliance teams still start with email?

Yes, but email breaks quickly as regulatory volume and cross-team dependencies increase, creating operational and regulatory risk.

What makes ComplyOS different from email or trackers?

ComplyOS centralizes regulations, maps impact automatically, assigns ownership, and maintains a live audit trail - none of which email can do.

How does ComplyOS improve collaboration?

Each team sees only relevant regulatory impacts, works in parallel, and updates flow automatically across the organization.

Is ComplyOS built specifically for insurance?

Yes. ComplyOS is designed for U.S. insurance regulations, multi-state complexity, and insurer operating models by Comply.

Check our related articles

Deep Dive: Cross-Team Compliance Workflows

Final Takeaway

Email was built for conversations.

Insurance compliance is built on control, traceability, and speed.

ComplyOS doesn’t improve email.

It replaces the need for it.

Part 2 of this Article

Smruthi Kulkarni

Jan 6, 2026

Contact Now!

Let’s Connect. Reach out and we’ll get back to you as soon as possible.

Contact Now!

Let’s Connect. Reach out and we’ll get back to you as soon as possible.

Contact Now!

Let’s Connect. Reach out and we’ll get back to you as soon as possible.

Latest posts

Discover other pieces of writing in our blog

Foundational Content

© Copyright 2025. All rights reserved.