Additional Observations Regarding Advisers’ Compliance with the Advisers Act Marketing Rule

SEC Marketing Rule: What the December 16, 2025 Risk Alert Really Signals for Advisers

SEC Marketing Rule: What the December 16, 2025 Risk Alert Really Signals for Advisers

On December 16, 2025, the U.S. Securities and Exchange Commission (SEC) issued a new Risk Alert highlighting continued deficiencies in how investment advisers comply with the Marketing Rule (Rule 206(4)-1). While the rule has been effective for over three years, examination findings suggest that many firms are still struggling to operationalize its requirements -particularly around testimonials, endorsements, and third-party ratings.

This Risk Alert is not introducing new rules. Instead, it reflects how the SEC is interpreting and enforcing the Marketing Rule in real examinations - and that makes it especially important for advisers, compliance leaders, and marketing teams.

Key themes from the Risk Alert

A recurring issue identified by examiners is the lack of well-designed, firm-specific policies and procedures. Many advisers either failed to update their compliance programs or relied on generic documentation that did not reflect actual marketing practices. The SEC continues to emphasize that Marketing Rule compliance is principles-based and must be tailored to how each firm markets its services.

Another major concern relates to testimonials and endorsements. Examiners found that required disclosures—such as whether a promoter was compensated, the nature of any material conflicts, and who provided the testimonial—were often missing, unclear, or not presented in a “clear and prominent” manner. In several cases, disclosures were buried in hyperlinks or presented in a way that diminished their visibility.

Oversight of third-party promoters also remains a weak spot. Some advisers did not have required written agreements in place, failed to adequately document compensation arrangements, or used promoters who may have been ineligible under the rule. These gaps expose firms to heightened regulatory risk, particularly as digital marketing and influencer-style promotion becomes more common.

The Risk Alert also flags issues with third-party ratings. Advisers frequently lacked a reasonable basis for believing that surveys or questionnaires met the rule’s criteria. Required disclosures - such as the date of the rating, the identity of the rating provider, and whether compensation was paid - were often incomplete or absent altogether.

What this means in practice

The SEC’s message is clear: marketing compliance is now a mature expectation, not a transition exercise. Firms are expected to demonstrate proactive governance, documented review processes, and strong substantiation for every marketing claim. Boilerplate policies, informal reviews, or “we’ve always done it this way” approaches are unlikely to hold up in an exam.

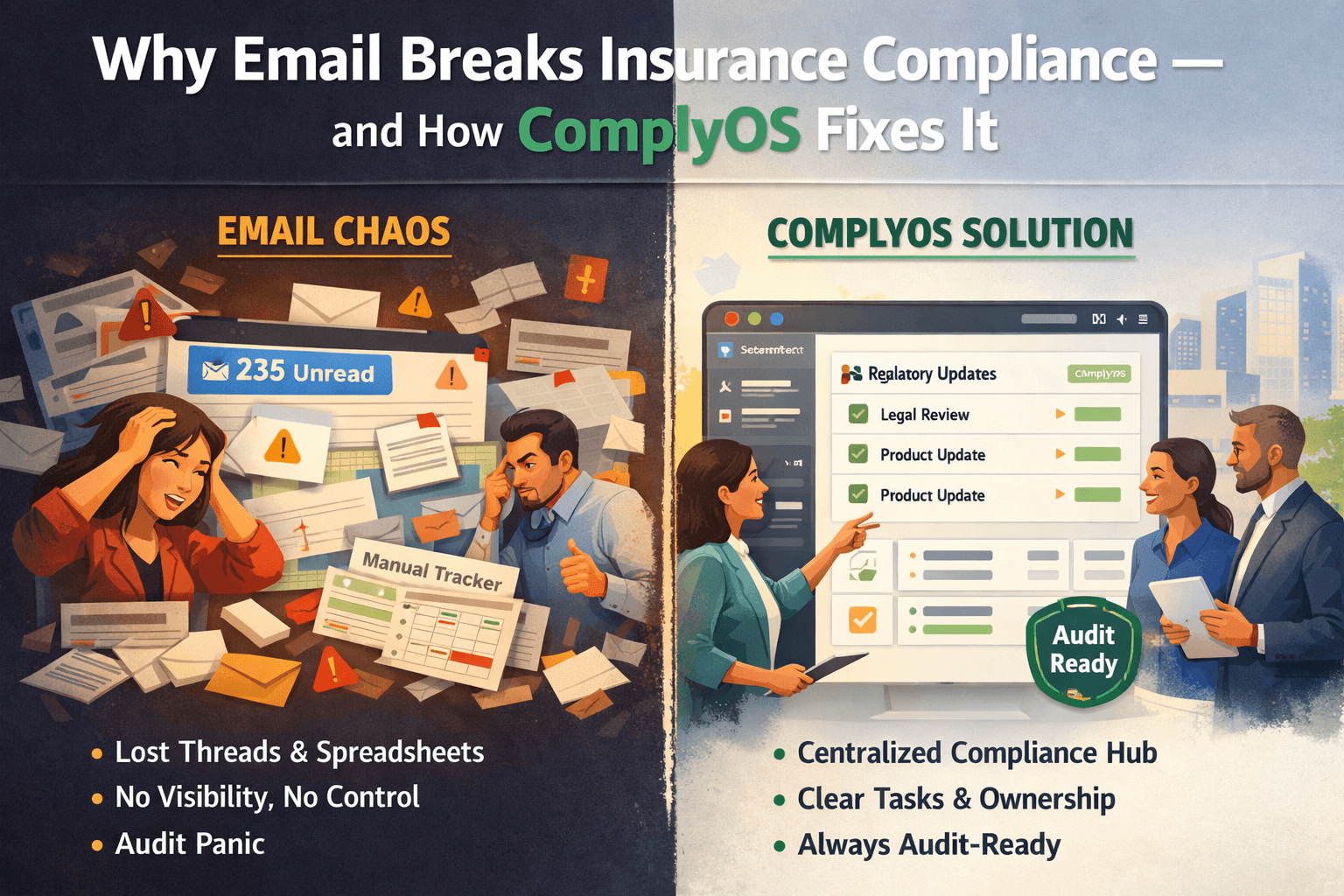

For advisers, this is a reminder to reassess how marketing content is created, reviewed, approved, and archived—and how third parties are monitored on an ongoing basis. For compliance teams, it reinforces the need for clear workflows, audit-ready documentation, and alignment between legal, marketing, and leadership.

Final takeaway

The December 2025 Risk Alert reinforces that the SEC is closely scrutinizing how advisers apply the Marketing Rule in real-world scenarios. Firms that invest now in clear controls, strong documentation, and thoughtful oversight will be far better positioned for future examinations than those relying on minimal or outdated compliance frameworks.

Sachin Kulkarni

Jan 4, 2026

Latest posts

Discover other pieces of writing in our blog